As you try to determine the best fit for you, consider a variety of options, including a budget binder with or without cash envelopes, a digital envelope system, spreadsheets, budgeting apps and more.

There are a lot of different ways to budget, including both physical and digital options. Focus on the budgeting style that works best for you Also, note that some websites may charge money for these templates or require that you pay for a course to access them.Īs a result, you’ll want to research a lot of different options to determine which ones are affordable and work best for your system.

Diy budget planner download#

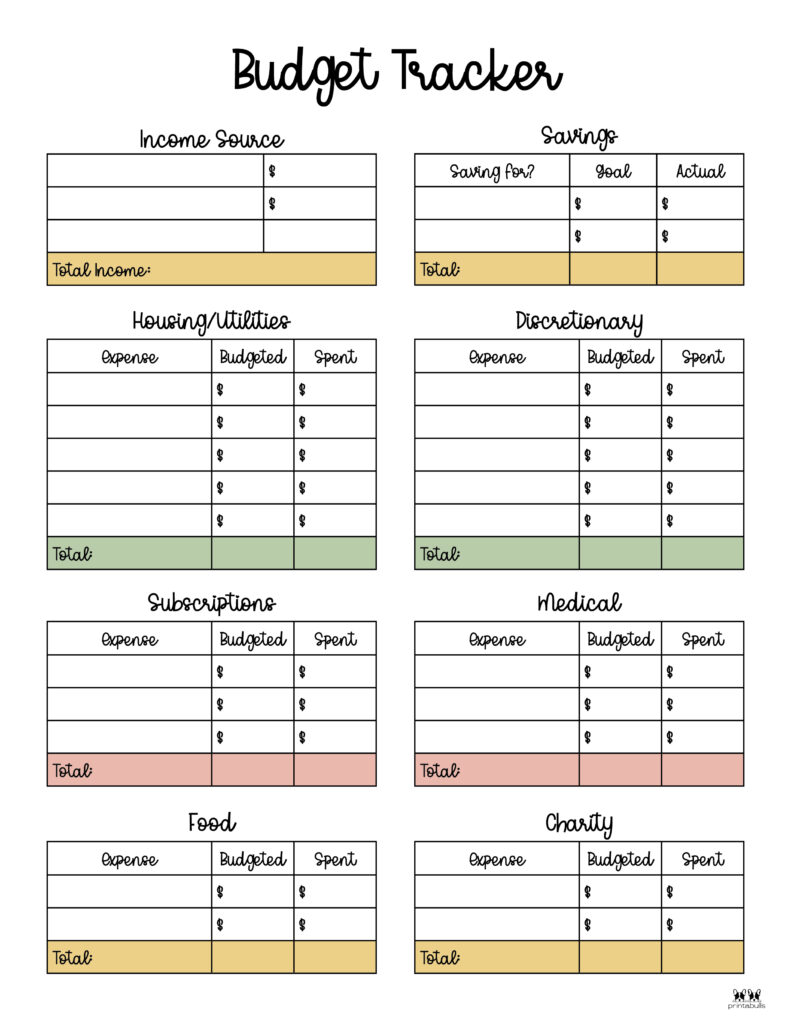

Once you’ve decided what type of budgeting binder you want to have and what you want to include in it, you’ll want to either create your own tracking worksheets or download online templates.Ī lot of budgeting templates are designed for Google Sheets or Microsoft Excel, which isn’t conducive to having everything on paper. Download templates or create your own trackers That said, you can also keep a lot of the documents that don’t require your attention regularly in a separate file box or cabinet and keep your budget binder less complicated. Income and expense tracking, including receipts.With more room, you can even expand what you include in the “binder,” including your: You can then buy folders and label them with each area of your plan. If you want to be detailed with your financial plan, you may consider going all out with a file box or filing cabinet. Depending on how comprehensive your financial plan is, though, keeping everything in one binder may make it too unwieldy. Keeping all of your envelopes in the binder is also an option, and you can even use dividers to split up each spending category. You can also purchase dividers with labels to keep things separate. With a three-ring binder, you can use the pockets on the inside of both covers to keep general plans and goals for your budget and separate tracking for income, expenses, specific goals and your progress toward them, receipts and anything else inside the binder. If you want a little help keeping your envelopes organized, there are budget binders available for purchase online that include “envelope” pockets, expense sheets, labels and more. This won’t make it easy to plan and keep track of other financial goals you have, but it could be a good starting point if you’ve never focused on money management and are feeling daunted by the process.

Each envelope will represent a different spending category, and you’ll assign a specific amount of cash each month to that category. If you want to keep your budgeting plan as straightforward as possible, you can simply use a box or filing cabinet to store your cash envelopes. Here are some ideas to consider: Stick to the envelopes There are a lot of different budgeting binders out there, so it’s important to take the time to consider multiple options and choose the one that works best for you and how you want to manage your money.

You can keep your cash envelopes in a binder for easy access and also use the budget binder to plan and keep track of the following:

Diy budget planner manual#

“A budget binder involves manual budgeting and tracking of spending and possibly even cash envelopes to break out that budget.” “It makes the whole process more tangible,” says Tom Drake, founder of MapleMoney, a Canada-based personal finance website. It allows you to keep all of your money management plans and paperwork in one place and keep everything organized in a way that works for you. What is a budget binder?Ī budget binder is essentially a day planner for your money. Here’s how budget binders work and a few budgeting binder ideas you can consider. In lieu of a budgeting app, a budget binder for cash envelopes can help you stay on track with this plan. This zero-based budgeting approach helps you avoid spending more money than you’ve allocated to each spending category every month. The envelope budgeting system is a cash-only method that’s popular among people who prefer to avoid using credit cards or are working to pay down debt. There are many different ways to set up your budget binder, including “DIY” approaches or by downloading worksheet templates.Budgeting binders can help you keep your finances organized, especially if you’re using the cash envelope system.

0 kommentar(er)

0 kommentar(er)